In its commitment to meet the ever-evolving lifestyle needs of its customers, APS Bank offers versatile banking channels to nurture enduring financial relationships. A network of 11 physical branches, a dedicated Contact Centre, ATMs and deposit machines, complement the Bank’s cornerstone digital offering: the myAPS internet and mobile banking application.

Designed to make the banking experience simpler and more personal, the myAPS app provides customers with secure and convenient access to manage any of APS Bank’s portfolio of personal and business financial products and services, including the APS Online Account with enhanced interest rates. Through myAPS, customers can also and effect online payments using SEPA and SWIFT transfers. SEPA transfers through myAPS for both personal and business are also now free of charge.

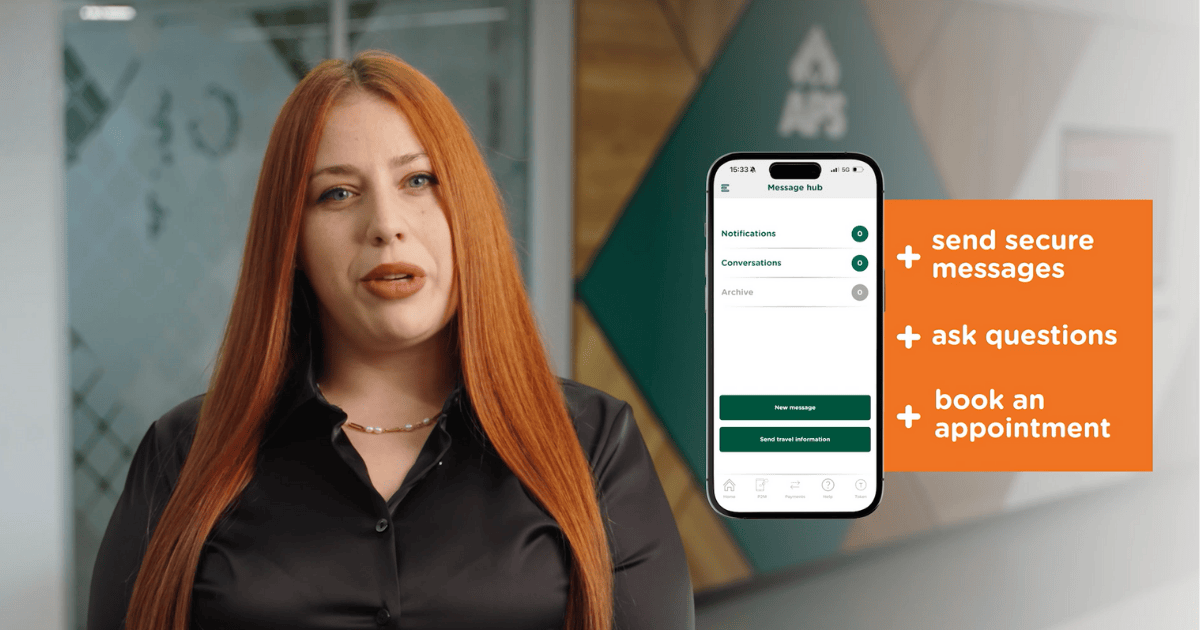

Improvements and developments to enhance the customer’s experience of digital banking are ongoing and driven by customer feedback. Gordon Gilford, Head of e-Channels at APS Bank, stated “In the latest myAPS update, we’ve introduced several enhancements, including additional assistance on the online sign-up journey, simplified bank transfers, and a quick access menu for frequently used functions. Message Hub features have been improved and we have also introduced the option of viewing and deleting standing orders using the app.”

With myAPS, the future of banking is at your fingertips. Explore these new features today and elevate your banking experience with APS Bank. For more information on myAPS, please visit apsbank.com.mt/internet-banking