The Board of Directors of APS Bank plc met on 25 July 2024 and approved the Condensed Interim Financial Statements for the half year ended 30 June 2024.

The period under review continued presenting a complex and dynamic landscape with economies moving at different speeds as they emerge from the shocks of recent years. Inflation remains a concern as major central banks try to balance between controlling price pressures and supporting growth with a more benign monetary policy outlook. Concurrently, geopolitical tensions affected energy prices, global trade and general investor confidence as volatility continues in the financial markets. Malta maintained its strong trajectory helped by record tourism numbers, exports of goods and services, low unemployment and high private consumption, leading to a GDP growth forecast of 4.6% for 2024. At the same time, Government intervention to contain inflation keeps piling pressure on the national debt and deficit, which however remain generally under control.

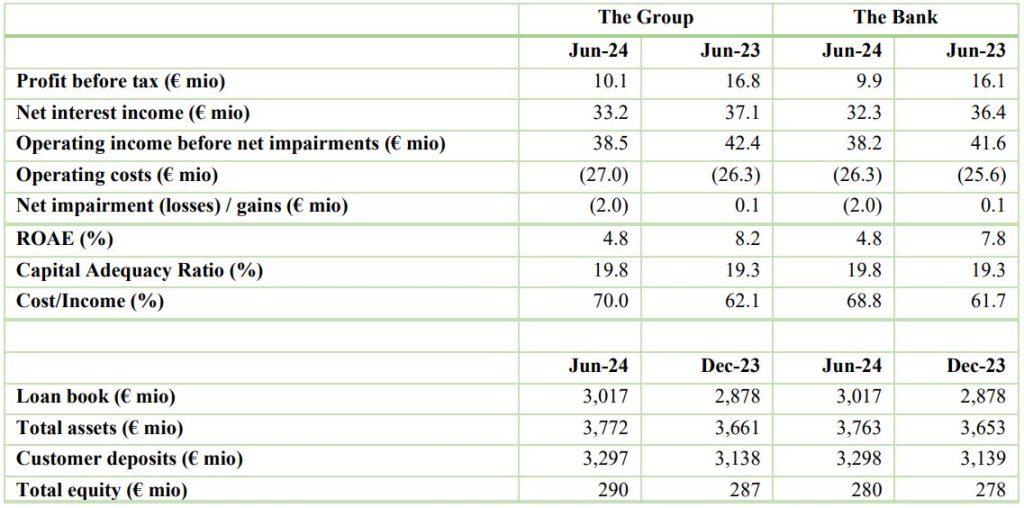

The following extracts are from the Condensed Interim Financial Statements for the period ended 30 June:

Income Statement

For the period under review, APS Bank plc delivered a pre-tax profit of €10.1 million (1H 2023: €16.8 million) at Group level and €9.9 million (1H 2023: €16.1 million) at Bank level. As already anticipated at the stage of 1Q 2024, returns were lower when compared to the same period last year mainly due to margin compression resulting from the higher interest rate expense, including from the MREL build-up late in 2023.

- APS Group generated interest income of €56.0 million for 1H 2024, up by €6.4 million compared to the same period in 2023. The growth in interest income was across the main credit product lines – retail, commercial and syndicated loans – as well as the liquidity holdings of cash and treasury instruments.

- Interest expense amounted to €22.9 million up from the €12.5 million recorded for 1H 2023. This is mainly due to the higher interest paid on euro deposits reflecting the pass-through of interest rates and significantly more competitive pricing on various savings products in an increasingly tight market.

- Net fee and commission income went up by 12.7% to €4.5 million (1H2023: €4.0 million). This increase is in sync with the growth in business activity of the Group, denoted by key commission streams related to advances, card related transactions and investment services.

- Other operating income for the first half of 2024 is €0.9 million, or €0.4 million lower than the comparative period. The reduction is mostly due to lower Group results in the trading of financial instruments at the level of its investment in the APS Funds SICAV plc Diversified Bond Fund.

- Net impairment losses for 1H 2024 were €2.0 million, reflecting credit charges across the three IFRS 9 stages spread over a growing local commercial book and the international syndicated lending portfolio.

- At the same time, and quite notably, the Group closed the six months with an NPL (non-performing loans) ratio of 1.9% – the lowest in years and reflecting the strength of the Group’s credit underwriting standards.

- Operating expenditure for the six-month period amounted to €27.0 million, up by 2.5% on 1H 2023. The marginal increase in costs is due to sustained investment in technology, regulatory and compliance requirements, professional fees and employee compensation. Cost-to-income ratio for the period under review was 70.0% (1H 2023: 62.1%).

Financial Position

h. Group assets stood at €3.77 billion, growing by 3.0% or €110.5 million. The main growth streams were:

- Net loans and advances to customers and syndicated loan portfolio which in aggregate grew by €138.4 million to €3.0 billion, with home financing once again being a main contributor;

- Countering the above increase in loans and advances, other debt and fixed income instruments contracted by €28.0 million.

i. Total liabilities closed at €3.48 billion, growing €108.0 million over the period. Key contributors to this growth were:

- Customer deposits which increased by €158.8 million. The mix was skewed in favour of term deposits, also reflecting the launch of the Kapital+ 18 in April 2024 – with overnight balances also growing on the back of further improvements to the Bank’s everyday banking proposition;

- Countering the above increase, a reduction in amounts owed to banks of €51.2 million.

j. Total equity at the end of 1H 2024 was €289.9 million, up by €2.5 million over the December 2023 closing of €287.4 million. The main contributors were:

- The scrip dividend paid for the financial year ended 31 December 2023, with €0.7 million being retained in equity;

- The profit for the period of €6.9 million.

k. The Bank’s CET1 ratio stood at 14.1% (1H 2023: 15.8%) and the Capital Adequacy Ratio at 19.8% (1H 2023: 19.3%).

Dividend

The Board is declaring the payment of an interim net dividend of € 2,000,000 (gross dividend of € 3,076,923). The net dividend equates to €0.00527 cents per ordinary share (gross dividend of €0.00811 cents per ordinary share). This interim dividend is subject to regulatory approval. Shareholders appearing on the Register on 22 August 2024 (last trading day 20 August 2024) will be entitled to receive the dividend.

CEO Marcel Cassar commented:

“Looking ahead, the second half of 2024 should see steadier global economic growth with an easing of monetary policy and further interest rate cuts as inflationary pressures continue to moderate. At the same time, regional differences, geopolitical risks and trade tensions will need to be managed carefully in order to calm down market volatility and potential asset price corrections. Against this landscape, the major European banks, including the core Maltese ones, have remained resilient, largely operating with ample liquidity and capital headroom that enabled them post record profits helped mainly by the high interest rate conditions. But there are beneath-the-surface challenges for banks as the environment remains highly dynamic and competitive.

APS Bank’s business model continues to take a more medium to long-term view beyond the recent interest rate cycle which has delivered super profits to some banks. The corrective actions we announced earlier this year to ease pressure on our margins started to yield results in 2Q, as profitability improved while our pricing remained competitive. We also stepped up our transformation programme as new products, services, channels and technologies are being rolled out to make APS Bank more the ‘primary bank of choice’ for our customers, in particular through a simpler banking experience. Despite the improvements in efficiency, revenue generation and all-round business expansion, thanks to the significant investments in technology and talent of recent years, we continue to actively explore further avenues of growth which can give us scale and also strengthen our market position.”

The Condensed Interim Financial Statements for the period ending 30 June 2024 can be viewed on the Bank’s website apsbank.com.mt/financial-information