Latest news

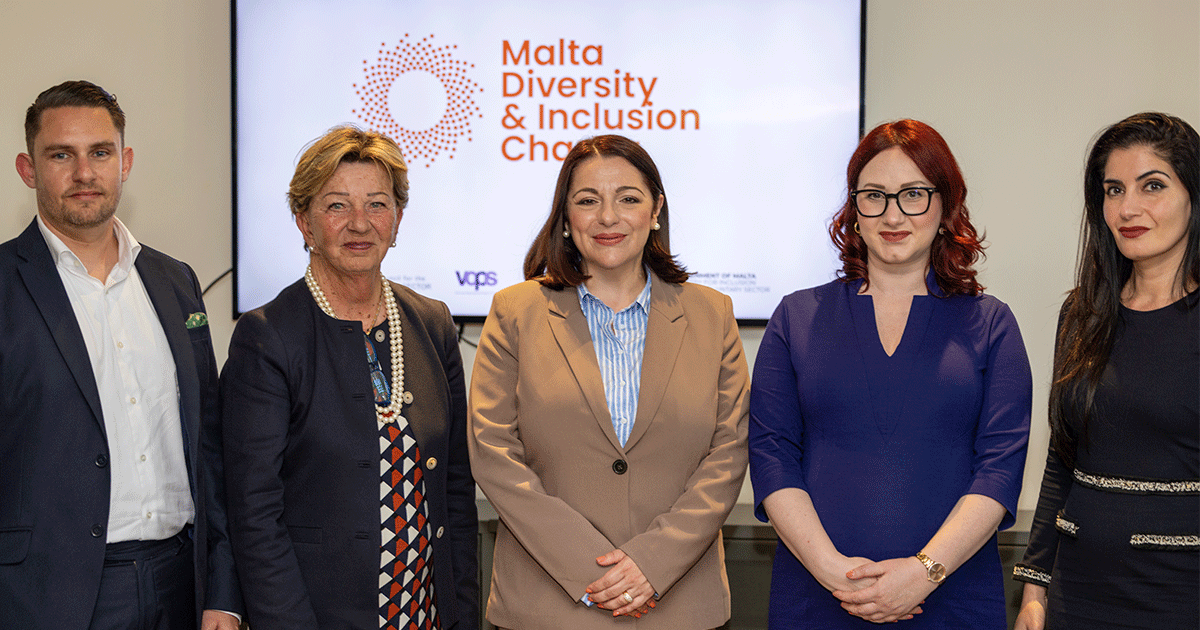

APS Bank signs Malta Diversity & Inclusion Charter

23 April, 2024APS Bank proudly announces its endorsement of the Malta Diversity & Inclusion Charter, marking a significant commitment to fostering diversity and inclusion wit...

Read more

Secure investment with APS Kapital Plus 18

19 April, 2024APS Bank has launched a new capital-guaranteed, structured deposit account, the APS Kapital Plus 18.

Read more

APS Bank introduces Google Wallet™

15 April, 2024APS Bank has introduced Google Pay, a digital wallet platform developed by Google, empowering customers to add their debit and credit cards for contactless paym...

Read more

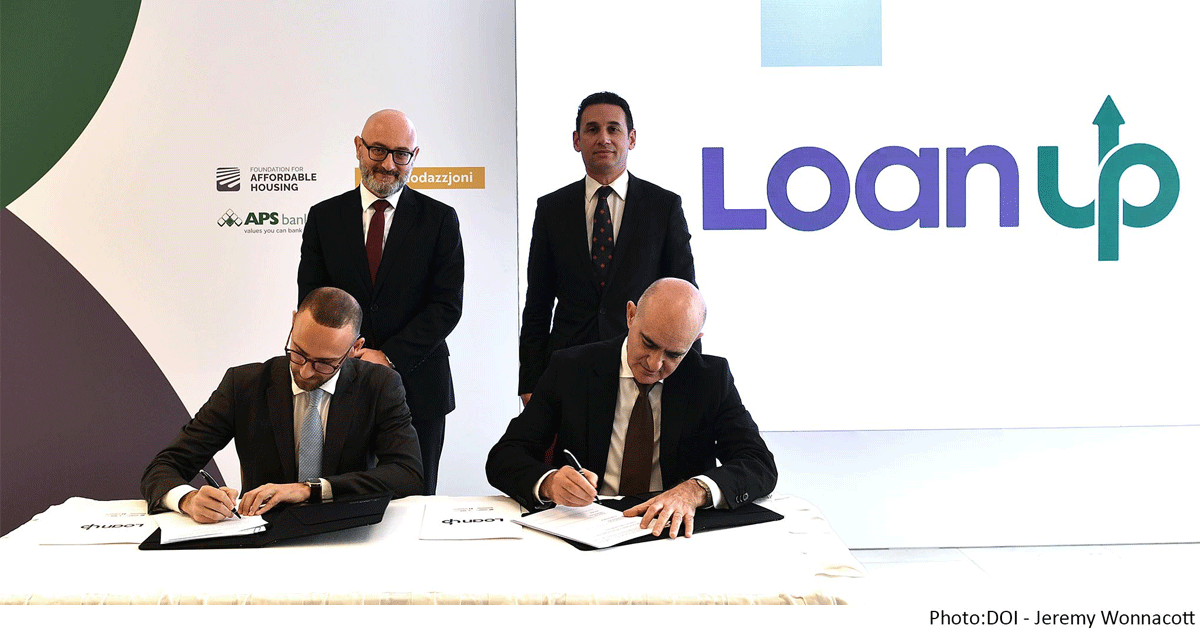

Affordable Housing Foundation and APS Bank introduce LoanUp

3 April, 2024The Foundation for Affordable Housing and APS Bank recently launched LoanUp, an innovative product offering enhanced borrowing rates and favourable terms, marki...

Read more

APS Bank Senior Management Offsite evaluates the challenger banks

28 March, 2024‘Delivering to our customers: what can we learn from challenger banks?’ was the theme of the first 2024 Senior Management Offsite. A challenger bank is a mo...

Read more

APS Bank hosts organisation-wide Teambuilding Programme

27 March, 2024‘Collaboration, Communication and Cooperation’ was the theme of the latest training and development initiative launched by APS Bank, designed to strengthen ...

Read more

APS Bank – For your bigger dreams

27 March, 2024APS Bank has proudly launched its new campaign entitled “For your bigger dreams”, highlighting the Bank’s commitment to being a stable and reliable bankin...

Read more

APS Bank supports numerous CSR initiatives

26 March, 2024March has been an extraordinarily active month, characterised by a multitude of events supported by APS Bank.

Read more

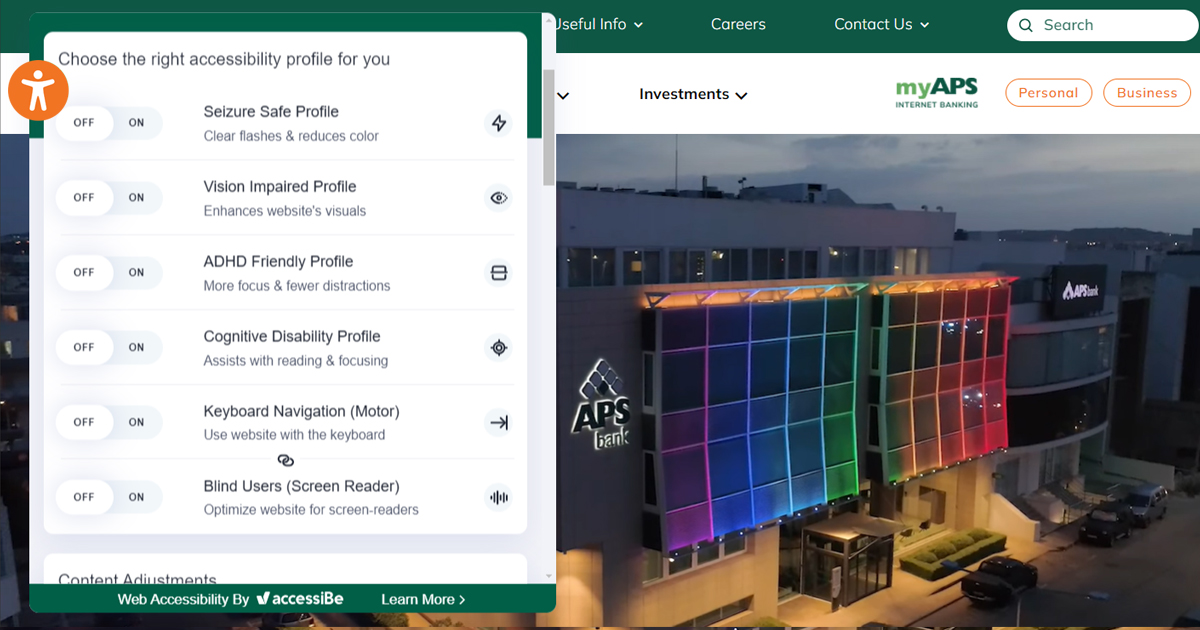

New accessibility functions on APS Bank’s website

22 March, 2024As part of the Bank’s ongoing website enhancement efforts, a new and improved accessibility function has been introduced, to ensure a seamless and inclusive b...

Read more