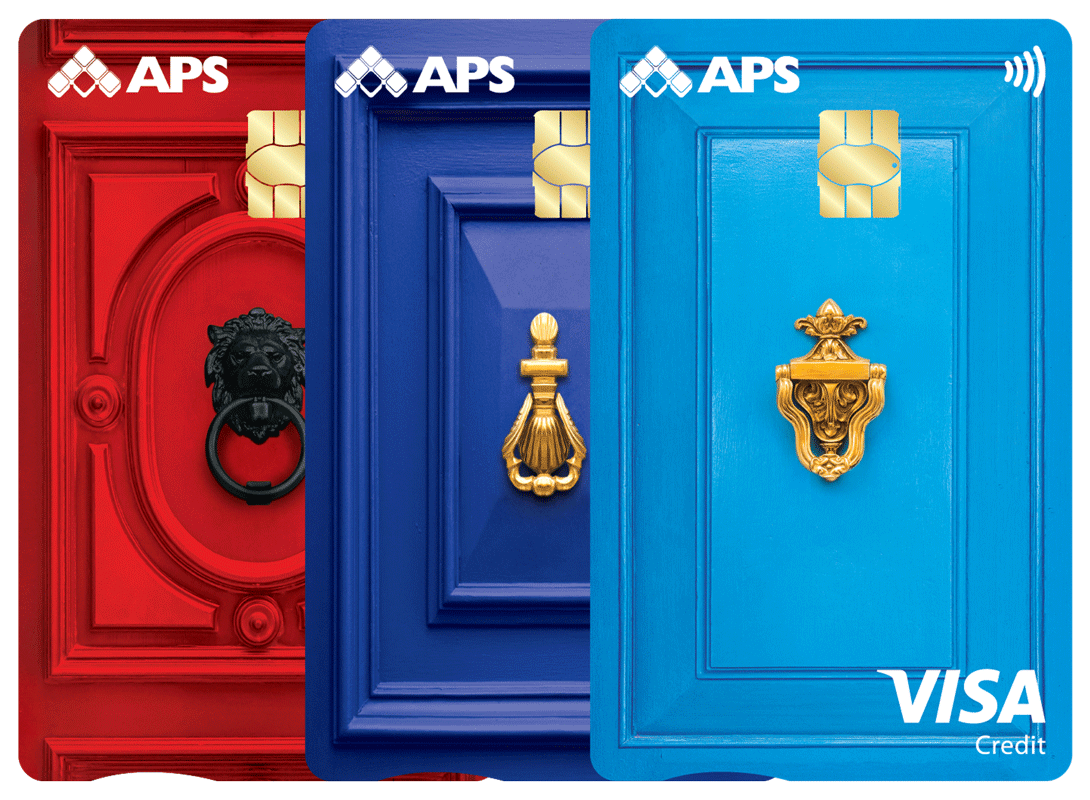

L-Iljun, l-Arzella, l-Imzejna, il-Pum tad-Deheb – these are the new APS Credit Cards, with no annual fee, cashback scheme and more.

Main features

- No annual fee

- Earn cashback on your purchases

- Contactless payments up to €50

- Use locally and overseas

- Pay online securely using 3DS

- Purchase protection insurance

- Control your card anytime, anywhere with myAPS

- Choose between l-Iljun, l-Arzella and l-Imzejna

Main features

- No annual fee

- Earn cashback on your purchases

- Contactless payments up to €50

- Use locally and overseas

- Pay online securely using 3DS

- Purchase protection insurance

- Travel insurance

- Vehicle hire excess protection

- Life insurance

- Control your card anytime, anywhere with myAPS

- Exclusive il-Pum tad-Deheb card

How to apply?

You must be:

- Over 18 years

- A myAPS mobile app user

For further information on eligibility kindly refer to the T&Cs below.

To apply:

- Contact us now or send a myAPS secure message to set an appointment.

- Download the form below, complete it and take it to your appointment with the required documentation listed in the form.

Further information

Annual Percentage Rate

The Annual Percentage Rate (APR) being charged on both classic and gold credit cards is 7.8% per annum. APR is the cost of borrowing on your credit card. It refers to the yearly interest rate you will pay if you carry a debit balance on your credit card.

Cashback

✓ Classic credit card holders will earn €0.01 for every €10

✓ Gold credit card holders will earn €0.02 for every €10

✓ All cashback earned will show on your credit card statement

✓ Cashback earned will be added to your account immediately

Download the insurance documents

Valid from 23 May 2025

Valid until 22 May 2025

FREQUENTLY ASKED QUESTIONS

Credit Cards

- Log in to myAPS app

- Tap on the menu in the top left

- Tap on Credit Cards

- Select Pay Card

- Select account

- Enter Value Amount

- Enter Payment Reference

- Select Confirm

- Tap Yes

- Enter your myAPS PIN

- Tap Confirm

- Log in to the myAPS app

- Tap on the menu in the top left

- Tap on Credit Cards

- Select Credit Card Overview

- Select the credit card you would like to (un)freeze

- Tap on the 3 dots icon in the top right

- Select Freeze Card or Unfreeze Card as required

- Confirm selection

- Log in to the myAPS app

- Tap on the menu in the top left

- Tap on Credit Cards

- Select Credit Card Overview

- Select the credit card you would like to activate

- Tap Activate Card

- Tap Close

- No annual fee

- Interest rate at 7.5% i.e. 5.25% over the Bank’s Base Rate

- Minimum payment for at 5% of the debit balance of €15 whichever is the highest

- APS ATMs withdrawals - charge is of 0.30% of the withdrawn amount (minimum €0.30).

- Other local and international ATMs withdrawals - a fixed €3 charge along with the 0.30% of the payment amount.

Contact us now

"*" indicates required fields

Representative Example

Credit cards interest free period scenario when a customer performs purchase transactions at any of the point of sale or ecommerce outlet:

- First purchase transaction performed in current billing cycle: €100 on 1 June.

- Second purchase transaction performed in current billing cycle: €200 on 20 June.

- Statement date: 27 June (for all the transactions in each billing cycle when the statement is generated)

- Payment due date: 21 July (the date by which customer need to make minimum payment to avoid late payment fees and delinquency)

- Interest free period for first purchase transaction: 56 days (date when the transaction is performed to payment due date)

- Interest free period for second purchase transaction: 30 days (date when the transaction is performed to payment due date)

The total interest will be calculated on the outstanding amount (€300) at the end of each billing cycle on the payment due date and will be charged accordingly. If the customer settles full outstanding balance by the payment due date, no interest is charged.

Cash withdrawals are not subjected to interest free period.

APS Bank plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994 and to carry out Investment Services activities under the Investment Services Act 1994. The Bank is a participant in the Depositor Compensation Scheme established under the laws of Malta. Applications are subject to the Bank’s lending criteria. Terms and conditions apply and are available on apsbank.com.mt/terms-and-conditions.