Corporate Governance

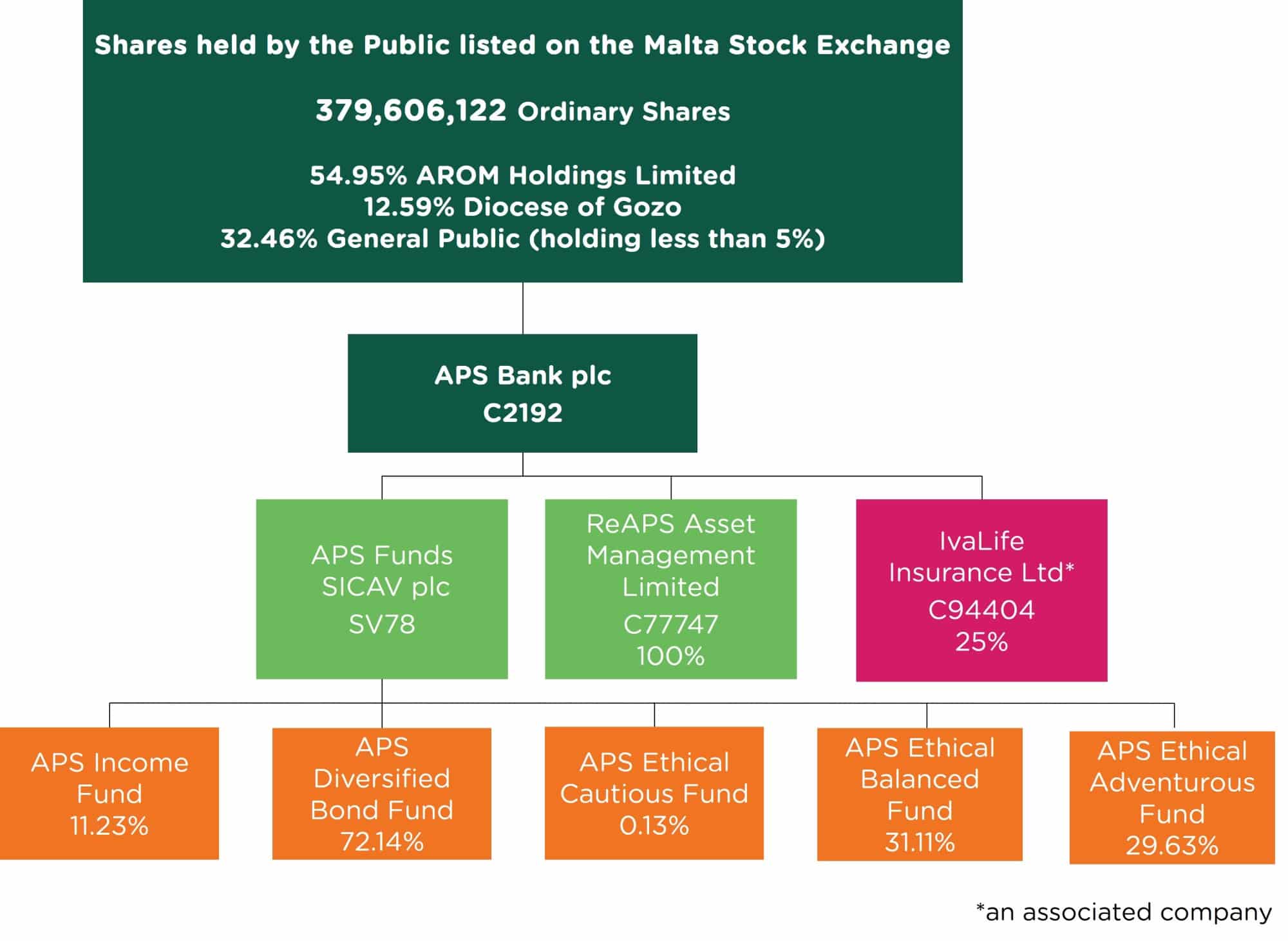

Corporate Structure

The following diagram illustrates the corporate structure of the Group:

Memorandum and Articles of Association

9 May 2024

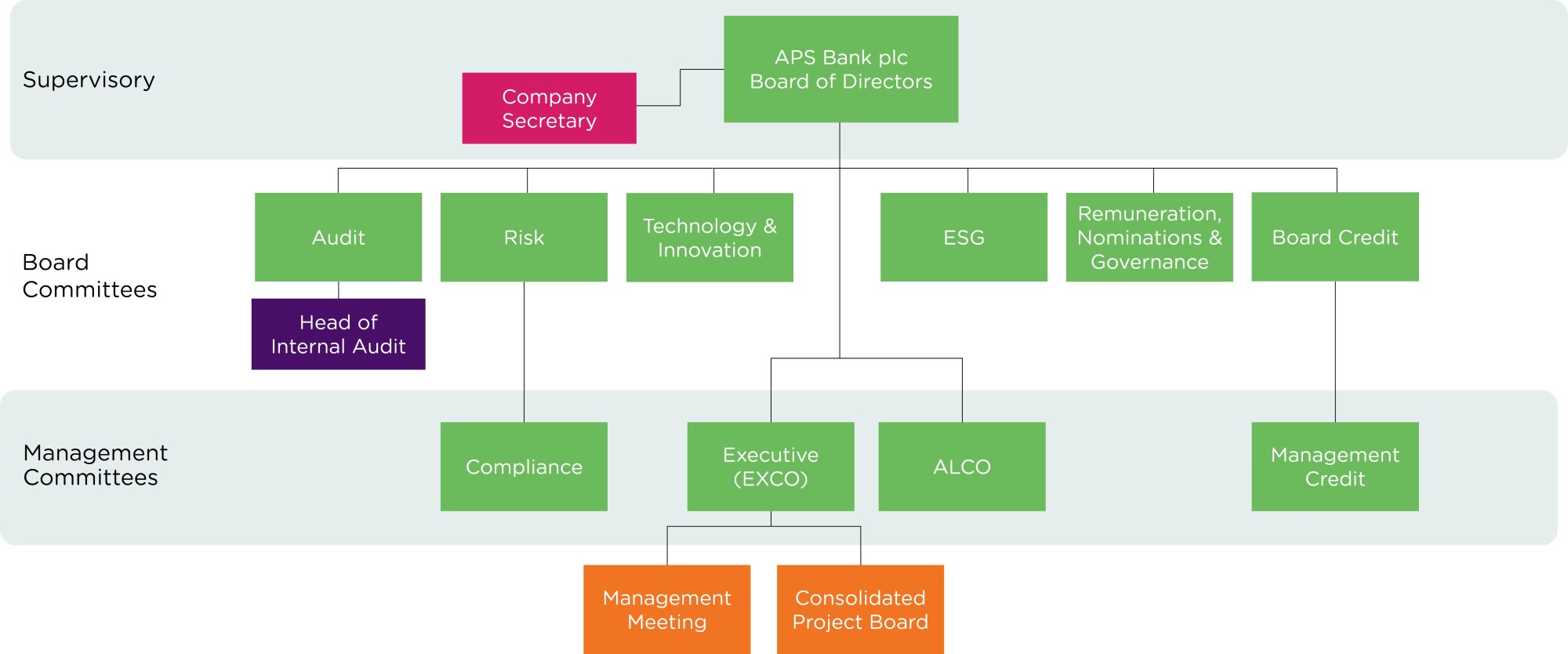

Corporate Governance Structure

Board Committees

Audit Committee

Assists the Board in monitoring the integrity of the financial reporting process, including the audit of the annual accounts and review of any interim reporting, and ensuring an effective system of internal controls and the effectiveness of the Internal and External Auditors.

Risk Committee

Has a wide mandate for risk oversight, including credit risk, market risk, reputational risk, operational risk, technology and cyber risk, concentration risk, liquidity risk as well as compliance and reputational matters, and reviews the Bank’s risk management framework accordingly.

Remuneration, Nominations & Governance Committee

Keeps the Board composition under review and carries out the process for Board appointments and assists the Board on senior management appointment and succession planning.

Recommends the compensation framework of Board and senior executives.

Ensures the Bank is in line with corporate governance practices.

Technology & Innovation Committee

Oversees management with regard to IT-related risks, security and business continuity plans.

Provides strategic leadership through a steady flow of innovative ideas that will serve as a catalyst for innovation at the Bank as well as monitoring IT project implementation.

Board Credit Committee

Reviews credit applications and approves credit limits for customers and transactions, within the parameters set by the Board in terms of the credit policy procedures.

Reviews emerging issues and concerns relating to the performance of the portfolio, including to specific sectoral exposures.

ESG Committee

Considers the material ESG issues and policies relevant to the Bank’s business activities and promotes initiatives to raise ESG performance.

Oversees the implementation of social sustainability initiatives and commitments, including performance, challenges and opportunities, to ensure their effectiveness in delivering social impact.

Management Committees

Executive Committee

Acts as consultative body and advisor to the Chief Executive Officer on matters such as strategy, operations and business.

Focuses on the four Ps, namely Performance, Products, Projects and People, and these four broad areas describe adequately the coverage of this Committee.

Assets-Liabilities Committee

Generally responsible for the asset liability management (ALM) strategy, policy, surveying of market developments, including the Bank’s Base Rate and funding strategy.

Focuses on liquidity management and contingency planning, determines the liquidity strategy.

Management Credit Committee

Receives and reviews credit applications and approves credit limits for customers and transactions, within the parameters set by the Board in terms of the credit policy and procedures.

Refers and recommends to the BCC limit applications where these exceed its MCC limits.

Compliance Committee

Ensures that prescribed regulations, rules, policies, guidelines and procedures are being followed and also anticipated in advance. Acts as a decision point for business acceptance, onboarding and dismissal of customers, in line with the Bank’s on-boarding and exit policies.

The Compliance Committee reports to the Risk Committee.

Weekly Management Meeting

Reports to EXCO, with which it also works very closely.

The Meeting brings together the senior levels of management – Chiefs and Heads – in a weekly forum where all members share updates about their respective areas of responsibility, work plans as well as matters or items of significant interest.

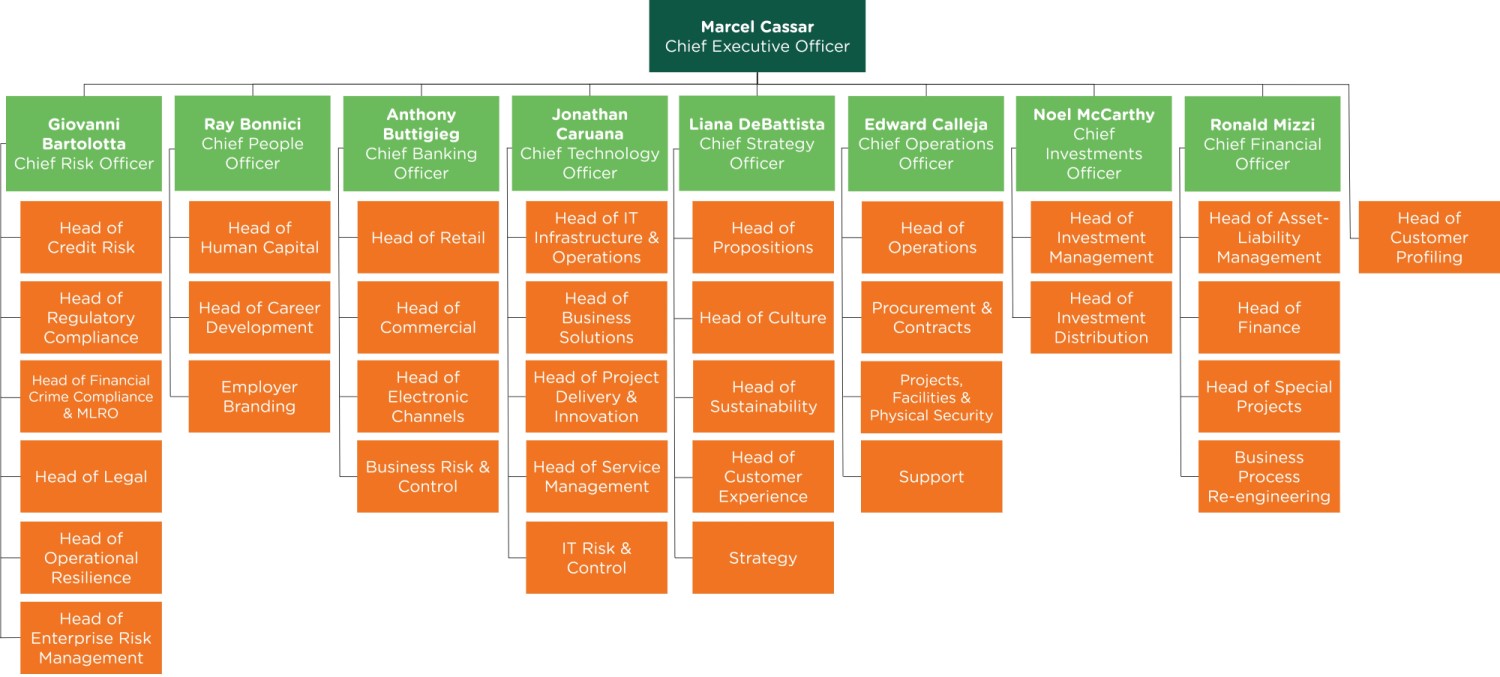

Organisational Chart

APS Bank’s various departments are reflected in the following organisational chart, which also depicts the senior management team: