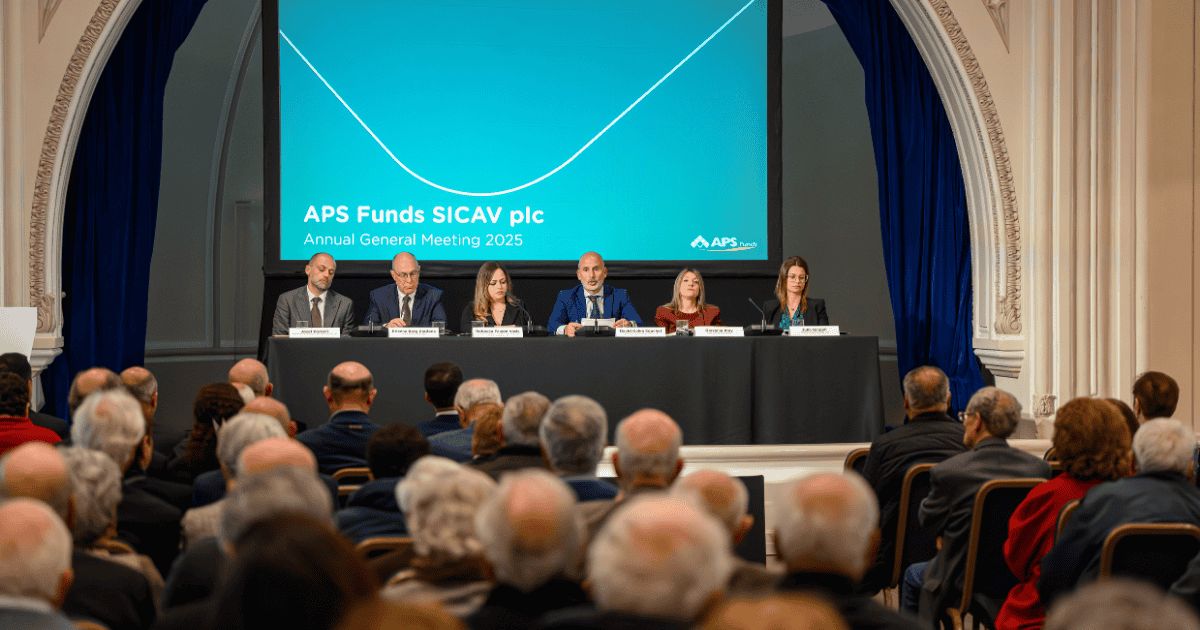

Left to right: Marvin Farrugia (Head of Asset Liability Management, APS Bank), Anthony Buttigieg (Chief Banking Officer, APS Bank), Liana DeBattista (Chief Strategy Officer, APS Bank), Maria Xuereb (Chief Credit Officer, MDB), Paul V. Azzopardi (Chief Executive Officer, MDB) and Joseph Darmanin (Chief Business Development Officer, MDB)

APS Bank and the Malta Development Bank (MDB) signed an agreement on Wednesday, 10 July 2024, further solidifying their collaborative efforts to foster business growth and economic development locally. Building on their existing partnership, the banks have jointly launched two products: the MDB SGS Business Loan, part of the SME Guarantee Scheme (SGS), and the newly introduced MDB Co-lending Business Loan under the Guaranteed Co-Lending Scheme (GCLS). These offerings provide businesses a suite of advantages, including lower interest rates, extended loan terms, reduced collateral requirements and broader eligibility criteria.

During the event, Liana DeBattista, Chief Strategy Officer at APS Bank, stated “The ongoing collaboration between APS Bank and the Malta Development Bank represents a significant step forward in providing businesses with the tools they need to thrive. These products not only facilitate access to financing but also contribute to sustainable economic growth. We are excited about the opportunities that these initiatives create for businesses and look forward for their continued success.”

Paul V Azzopardi, CEO of the MDB, stated that they were very pleased that APS Bank has decided to become an intermediating partner bank in MDB’s SME schemes. “By partnering with APS Bank, a major player in SME lending in Malta, we aim to provide businesses with simplified and more affordable access to finance. This collaboration will enable firms to undertake necessary transformations for sustained growth in the coming years.”

More information is available on apsbank.com.mt/mdb.