Explore the world of investing with the APS Investment Chats. Join us for three engaging sessions, where you can learn how to build your financial future, plan for a secure retirement, and make better investment decisions.

Join the conversation, learn from experts, and get answers to your questions. This is your chance to explore the world of investments.

Schedule

12 Nov: How to build your financial future

13 Nov: Will your pension sustain you?

14 Nov: How to think like a savvy investor

🕕 From 18:00 to 19:00

Session 1 - How to build your financial future

Tuesday 12 Nov, 18:00-19:00 | Delivered in Maltese

Growing your finances for the next generation is not just about saving; it is about making the right investment choices at the right time. In this session, we will explore when to start investing and how to protect your assets. You will learn about different investment options, managing risks, and creating a balanced portfolio that aligns with your goals. A notary, Dr Roland Wadge, will also be on the panel. A Q&A session will follow, where you can ask your questions to our experts.

Speakers

Roland Wadge - Notary Public

Roland is a Notary Public with over 25 years of experience in the legal profession. He graduated with a Notarial Diploma in 1995 and earned his Doctor of Laws degree in 1997. That same year, he obtained his warrant to practice as a Notary Public, marking the beginning of his legal career in Malta.

He has been an active member of the Notarial Council for the last 25 years, currently serving as its President. One of the significant reforms he contributed to was the modernization of notarial laws in Malta (2011 onwards), aimed at improving the functioning and efficiency of the profession.

In addition to his current responsibilities as President of the Notarial Council, he was recently appointed as the rotational Vice-President of the Council of the Notariats of the European Union (CNUE). He has also contributed to legal education in Malta, having served as a lecturer in Fiscal Law at the University of Malta for several years and has also published in the legal publication “Id Dritt” by Gh.S.L in 2015.

Alan Agius - Investment Services Advisor, APS Bank

Alan has built a solid career in the financial sector, showcasing his ability to manage assets and provide reliable client service. Alan studied at the University of Malta, earning a Bachelor of Commerce in Management and Banking and Finance, followed by an Honours degree in Banking and Finance.

Over his 16-year career, Alan has held various roles, most significantly as an Investment Advisor from 2010 to 2019. In this role, he managed diverse investment portfolios, ensuring they were aligned with clients’ financial objectives and risk tolerance.

Alan’s commitment to client relationship management involved building and maintaining strong relationships, ensuring high levels of satisfaction and trust, and addressing client inquiries and concerns promptly. Since April 2020, Alan has been working as an Investment Advisor at APS Bank plc, continuing to provide expert financial guidance to clients.

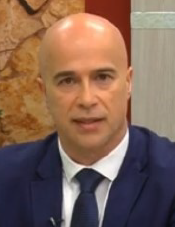

Adrian Francalanza - Private Clients Investment Advisor, APS Bank

Adrian is a financial services professional with over 8 years of experience in the industry. Currently serving at the Private Clients Unit at APS Bank, Adrian specialises in the areas of investment management, financial planning, and research. He has worked at various retail branches and is officially licensed as a wealth financial advisor by the MFSA.

Adrian joined APS Bank after his graduation with Honours in Banking & Finance from the University of Malta and is in the final stages of obtaining his Executive Master in Business Administration from the University of Malta.

He is dedicated to advancing the field of financial services and continues to assist individuals to help them better navigate complex financial and political landscapes.

Session 2 - Will your pension sustain you?

Wednesday 13 Nov, 18:00-19:00 | Delivered in English

The state pension might not cover everything you need for retirement, so what can you do now? In this session, our experts will discuss why it is important to plan early and how you can secure your future today. Anthony Borg, Director of the Department of Social Security, will explain how the pension system works and what steps to take as you approach retirement. The panel will also explore how to create multiple income streams during retirement and discuss tools available to help fill any financial gaps. A Q&A session with our experts will follow.

Speakers

Anthony Borg - Director, Department of Social Security

Anthony has been engaged in the Public Service since 1992 within the Department for Social Security. He experienced the real feel of social welfare in the District Offices through customer care and later as District Manager and subsequently Regional Co-ordinator.

In 2019 he was appointed Assistant Director Single Means Test and Business Intelligence, within the Income Support and Compliance Division. His remit included the Business Intelligence Unit, In-Work Benefit Unit, Energy Benefit Unit, Overpayment Unit and Supplementary Allowance Unit. Operations entails a lot of research, in-order to establish eligibility, with subsequent fair distribution among citizens.

He is currently utilising the experience gained throughout the years for the benefit of the Ministry for Social Policy and Childrens’ Rights, as Director Contributory Benefits.

Darran Agius - Corporate Schemes Relationship Manager, APS Bank

Darran is the Corporate Schemes Relationship Manager at APS Bank, responsible for developing and growing the APS Pension offering and providing tax-efficient employee retention solutions to corporate customers. He joined APS Bank in September 2018 as a Private Clients Relationship Manager, managing high-net-worth investment portfolios.

He joined the financial sector in 2003 and gained extensive experience in various areas, including commercial insurance, personal and corporate credit, and pensions.

Darran holds a Bachelor of Commerce degree from the University of Malta, a BSc (Hons) Financial Services degree from the University of Manchester, and an MSc in Human Resource Management and Development from the University of Leicester.

Mark Lamb - Corporate Schemes Manager, APS Bank

With over 25 years of financial services expertise, Mark is qualified and authorised by the MFSA to provide investment, pensions, and insurance advice. In 2018 he was approved by the regulator to act as a Portfolio Manager.

Mark is a member of the UK’s Personal Finance Society and Chartered Insurance Institute. Before moving to Malta in 2003, he worked for the UK’s largest pensions provider and served as an Independent Financial Advisor for one of the UK’s longest established advisory firms.

Additionally, he was a weekly business columnist for Malta Today for over 5 years.

Session 3 - How to think like a savvy investor

Thursday 14 Nov, 18:00-19:00 | Delivered in English

Understanding how our minds affect financial decisions is important for all investors. In this session, we will explore behavioural finance and discuss common biases that can impact your investment choices. Our experts will share real-world examples and practical strategies to help you make more informed and data-driven decisions. We will engage in discussions and close with a Q&A session.

Speakers

David Lanzon - Senior Portfolio Manager, ReAPS Asset Management

David is a Senior Portfolio Manager at ReAPS Asset Management Ltd, a subsidiary of APS Bank. Since joining the team in 2017 he has been responsible for managing discretionary customer portfolios and co-managing APS Funds.

He is a regular contributor to the Firm’s investment views and trade idea generation, with a special focus on international credit and the Maltese financial market. His previous experience includes key positions in investment management at HSBC Global Asset Management Malta and a six-year stint at the Central Bank of Malta.

David holds a Master’s degree in Economics from the University of Malta and was awarded the CFA charter in 2015.

Mark Muscat - Portfolio Manager, ReAPS Asset Management

Mark is an Portfolio Manager at ReAPS Asset Management Ltd, a subsidiary of APS Bank. He joined the team in 2022 and assists the Portfolio Managers in managing discretionary customer portfolios and APS Funds.

Mark's understanding of financial markets helps him identify new investment opportunities and economic developments, with a focus on international credit and global equities. Previously, Mark was a Financial Analyst at a local asset management firm for eight years, where he recommended specific stocks, bonds, or other assets to buy or sell.

Mark holds a Master's degree in Banking and Finance from the University of Malta.

Michael Tabone - Senior Portfolio Manager, ReAPS Asset Management

Michael started his career in 2008 at Qube Services, in fund and company administration and formation in Malta. He joined Oceanwood Capital in 2010 as a Research Analyst responsible for idea generation and fundamental research across asset classes.

Michael moved to Oceanwood’s London office in 2014, where he worked for six years, forming part of a team reporting to the Chief Investment Officer with a focus on European bank subordinated credit and event-driven investment opportunities across the capital structure. Michael joined APS Bank as a Portfolio Manager in January 2020.

Michael is a Chartered Financial Analyst, a member of the UK CFA Society, and has an Honours degree from the University of Malta in Banking and Finance.

Watch the previous editions

Approved and issued by APS Bank plc, APS Centre, Tower Street, B’Kara BKR 4012. APS Bank plc is regulated by the Malta Financial Services Authority as a Credit Institution under the Banking Act 1994 and to carry out Investment Services activities under the Investment Services Act 1994. The Bank is also registered as a Tied Insurance intermediary under the Insurance Distribution Act 2018.