The Board of Directors of APS Bank plc met on 10 March 2022 and approved the Group Annual Report and Audited Financial Statements for the year ended 31 December 2021.

Financial Performance

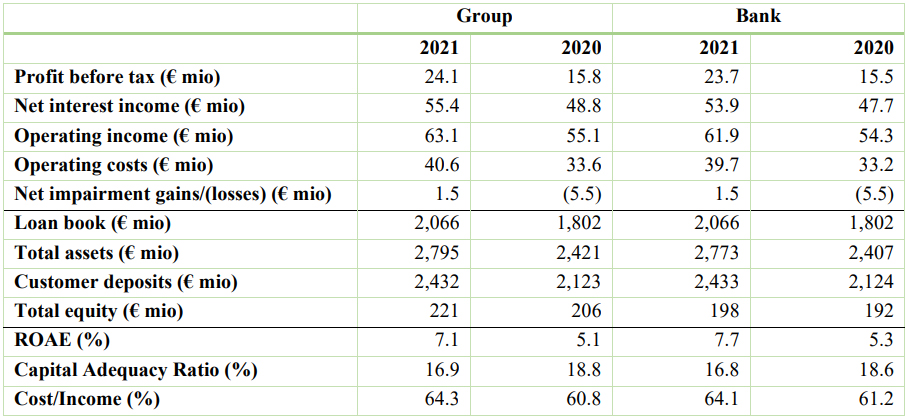

For the year ended 31 December 2021, APS Group registered a pre-tax profit of €24.1 million (2020: €15.8 million) an increase of 52.5%, while the Bank posted a record pre-tax profit of €23.7 million (2020: €15.5 million).

As the macroeconomic situation continues to create challenges for businesses and families, the Group’s resilience and strength of its business model was again manifest in such unprecedented times. These results were achieved while the APS Group continued to support the community in its many facets, ensuring business continuity and absorbing the financial impact of the current economic climate.

Net interest income grew by 13.3% to €55.4 million, driven mainly by the continued growth in the Bank’s lending book. Interest receivable on loans and advances increased by €6.8 million to €63.2 million. Interest expense remained at 2020 levels despite the significant growth in customer deposits, demonstrating the Group’s efficient asset-liability and funding management in the face of compressed interest margins. Net fee and commission income totalled €7.0 million, an increase of 34.3% or €1.8 million higher than last year. This growth results from an expanded customer base and increased services, in particular the provision of credit, general banking and investment services, including from the pension products offering launched in late 2020. Other operating income for the year was €0.8 million, down €0.3 million on 2020.

Operating expenses increased by 21.0% to €40.6 million, raising the cost to income ratio to 64.3%. The key drivers for the increase are the continuous investment in human capital to sustain operational growth and strengthen risk and compliance management, and various projects which are in motion, not least in the technology, aimed at improving the customer experience and the Group`s position within the industry.

Impairment against expected credit losses for the year amounted to a writeback of €1.5 million compared with a net charge of €5.5 million in 2020. The Group continuously assesses information and client performance especially in relation to the impact of COVID-19 on the credit portfolio, and the net write-back on credit loss estimates made in 2020 reflects the quality of the book, risk appetite in market circumstances that remain challenging and a vigilant approach to credit underwriting standards.

Financial Position

Group total assets at 31 December 2021 expanded by a further €374.0 million, or 15.4% reaching €2.8 billion. Lending activity grew by 14.7% to reach €2.1 billion. The demand for home loans steered this expansion by largely contributing to this increase, followed by commercial lending. The syndicated loans portfolio also grew by 18.7% to €134.3 million. In terms of liquidity management, a further €99.4 million in liquidity balances were placed with the Central Bank of Malta.

Funding grew by 16.2% to reach €2.6 billion, resulting from increases in both customer deposits and amounts owed to banks. The year closed with Group equity of €220.8 million, an increase of €14.6 million compared to prior year. The Group’s CET1 ratio stood at 13.0% (2020: 14.4%) and the Capital Adequacy Ratio at 16.9% (2020: 18.8%) – both ratios are being managed in line with regulatory thresholds including buffers.

The Directors are recommending that a gross dividend of 1.85 cents per ordinary share (net dividend of 1.20 cents per ordinary share) is paid to ordinary shareholders. The total gross dividend to be paid is €4,615,385 (total net dividend of €3,000,000). This dividend recommendation, which is subject to the final authorisation of the MFSA, will be presented for the approval of shareholders at the Annual General Meeting.

Overview and Outlook

Marcel Cassar, Chief Executive Officer, commented:

“We are pleased to be announcing these excellent results for a year when the Maltese economy was still trying to adapt to the new contours of a post-pandemic era with all the challenges that it still presents. These results confirm the strength of our business model which sees us gaining market share through improving our services and product lines, enriching the customer experience and continuing the strategic transformation of the Bank while supporting the community into the ‘new normal’.

At the same time, we are conscious of new uncertainties ahead especially in view of the evolving conflict in Ukraine and the geopolitical and economic repercussions that it is causing on a global scale. While the Group’s exposure in the region is immaterial, including to payment flows that might be impacted by crossborder economic decisions, we have heightened our risk and compliance monitoring as necessary, including enhanced sanctions screening.

2022 is a landmark year for APS Bank as it approaches the market to raise equity capital for the first time in its 112-year history. This long-awaited step is not a goal of prestige but an integral part of the plan agreed years back with the shareholders that sees us on a path of growth also through the diversification of the shareholder base. Our strategy of being a leading community bank has become increasingly about being a pillar of support for Maltese businesses and families, as the experience of recent years has shown. We look forward to the coming months with optimism for the successful execution of this important project.”

The Annual Report and Audited Financial Statements for the year ended 31 December 2021 can be viewed on the Bank’s website: https://www.apsbank.com.mt/financial-information